June 2025 Update

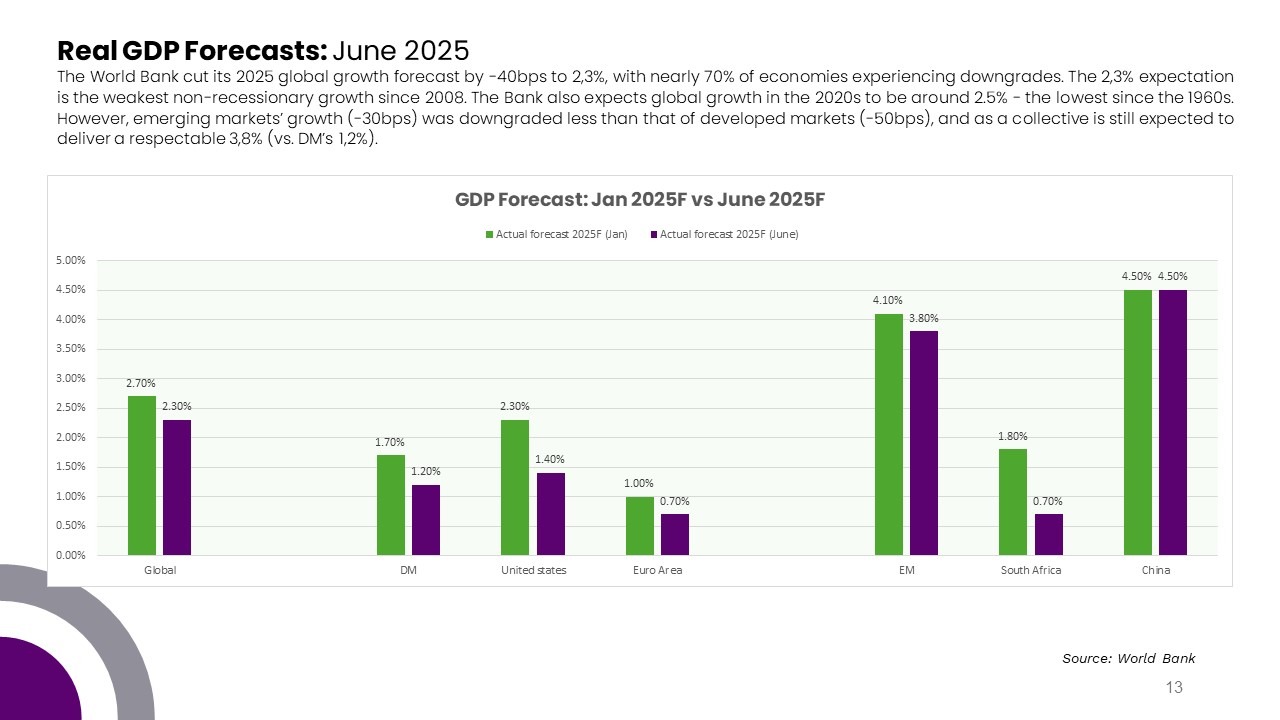

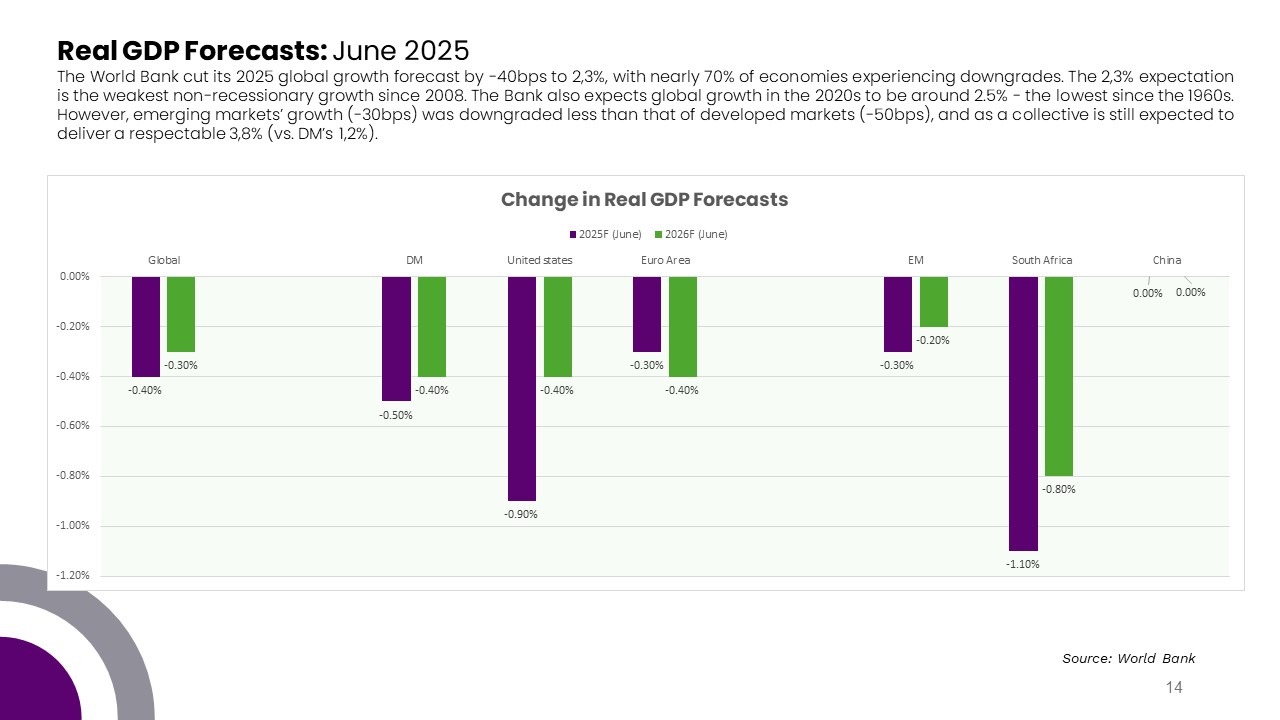

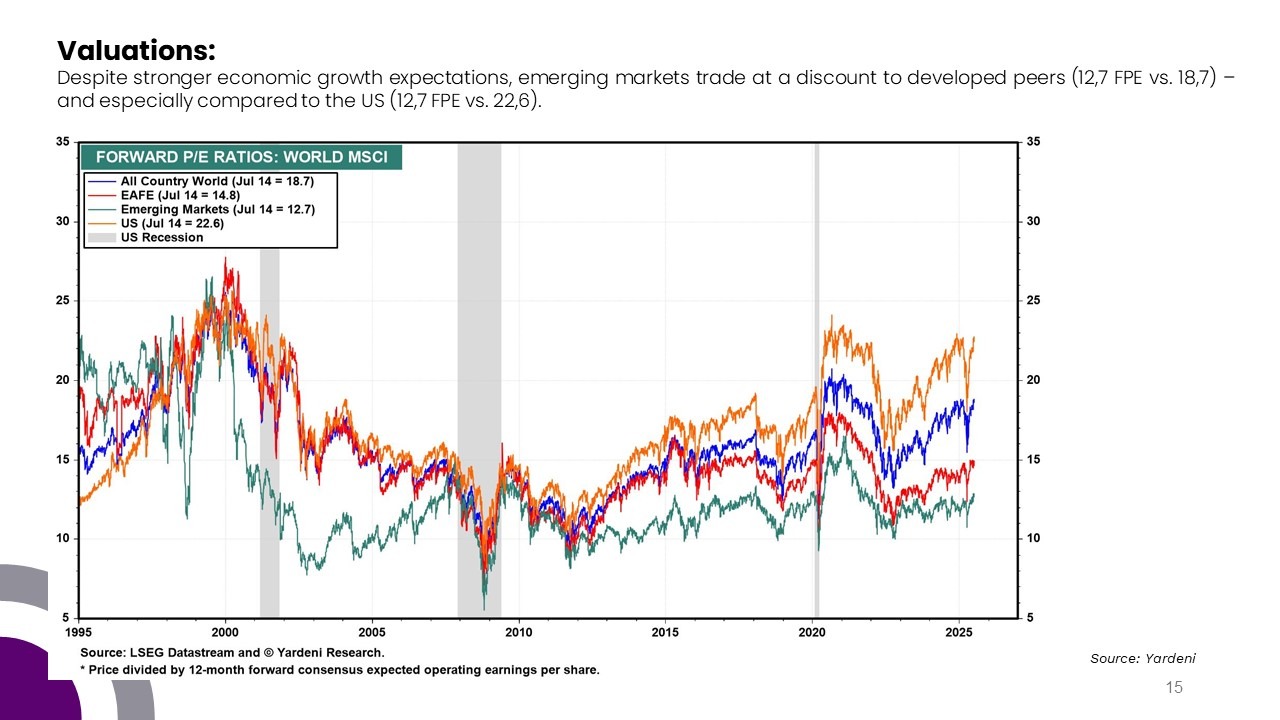

Making The News

- Greylisting Update

After grey listing south Africa back in February 2023, the financial action taskforce (FTAF) has granted South Africa an on-site assessment in October, which could mean the delisting of South Africa from the grey list. The FTAF delisting is expected to reduce due diligence and compliance costs for financial institutions and may encourage foreign flows back into South Africa.

- May’s US CPI downside surprise

Despite Trump’s Tariff Turmoil, May’s US CPI print rose below expectations to 2.4%. The inflation figure is expected to increase as the effects of frontloading stock subsides and the full impact of the tariffs unfold (shipments in transit before the 5th of April were tariff exempt until the 27th of May). Although US firms were recently using inventories on hand to avoid hiking prices, the Fed’s Beige Book notes that the firms expect to pass through the tariff costs to the consumer over the next three months. JP Morgan has estimated that the US CPI could more than double to 5.4% in 2025Q3.

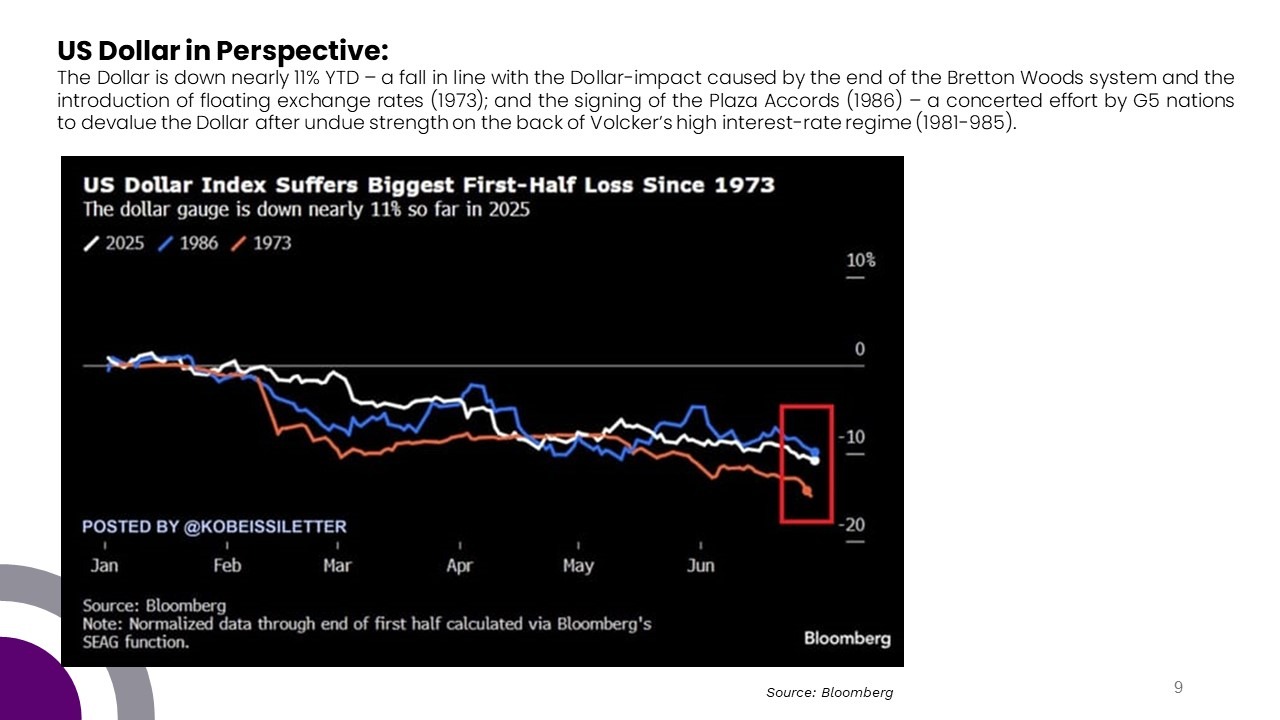

- Dollar weakness

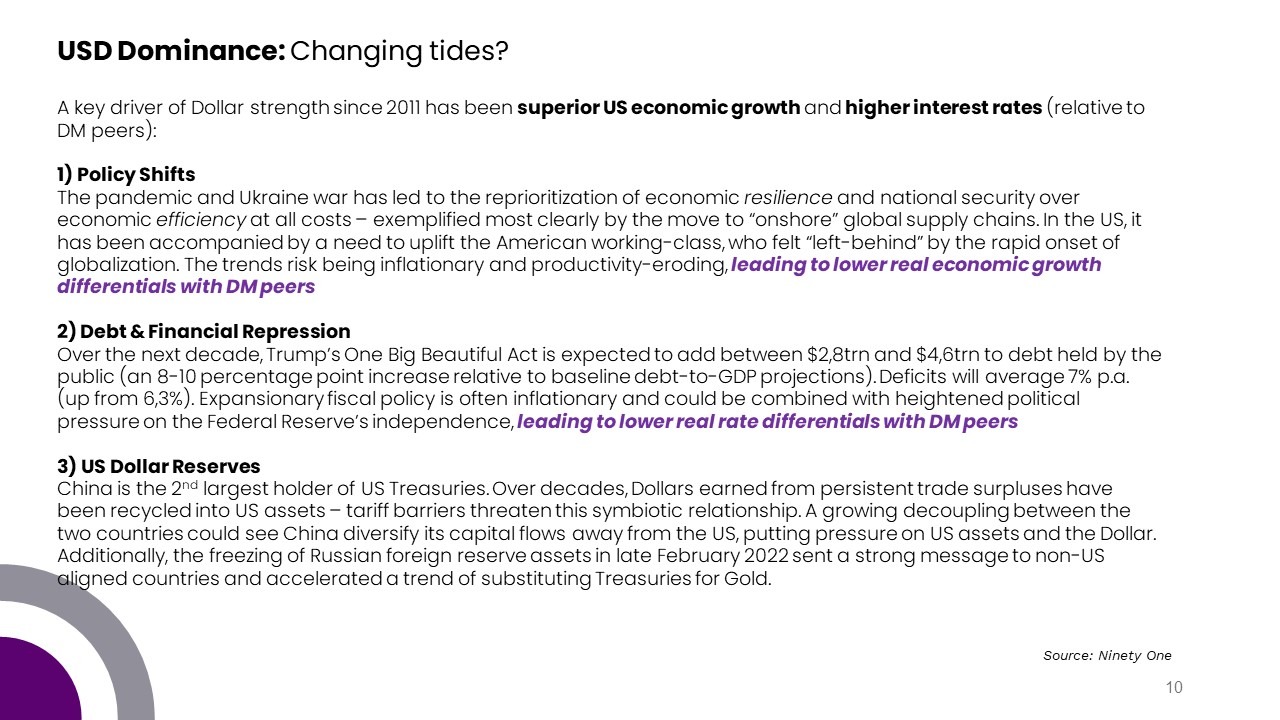

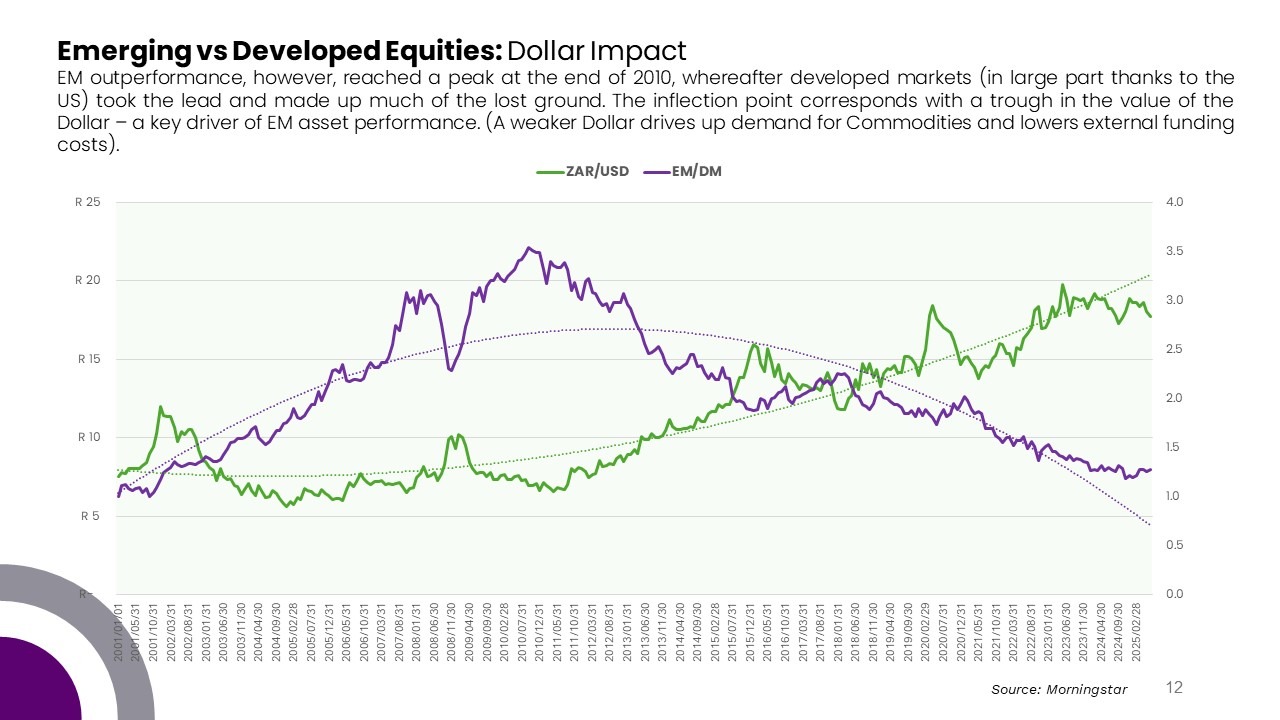

The US dollar has fallen by -10.7% YTD, marking the worst start to a year in 50 years. In the current environment of trade wars and a proposed budget that is expected to increase the borrowings by ±$3.2trn over the next 10 years, investors are contemplating their exposure to the US dollar. The US dollar has faced increasing scrutiny in recent years. Once accounting for approximately 72% of global foreign exchange reserves at the turn of the century, its share has steadily declined over the past 25 years, dropping to just 57% of total reserves.

- Precious Resource rally

South African equities have performed strongly YTD (+16.9%) with the majority of returns stemming from Gold Shares (+76% YTD) and Platinum miners (+83% YTD). Following last month’s rally (+28.5% MoM), Platinum prices are now at the highest price level since 2014 and industry experts have predicted that the strong demand and limited supply will restrain the metal in a supply-deficit for years. Unfortunately, the OECD have noted that Transnet and a general lack of reforms have resulted in SA missing out on some of the commodity rally. Highlighted by mining production declining by -7.7% in April and -2.5% in March due to increasing input costs, labour issues, illegal mining and logistical bottlenecks.